how to register for income tax malaysia

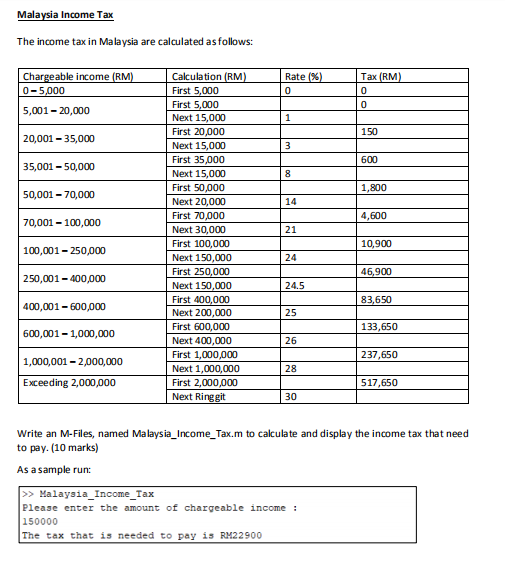

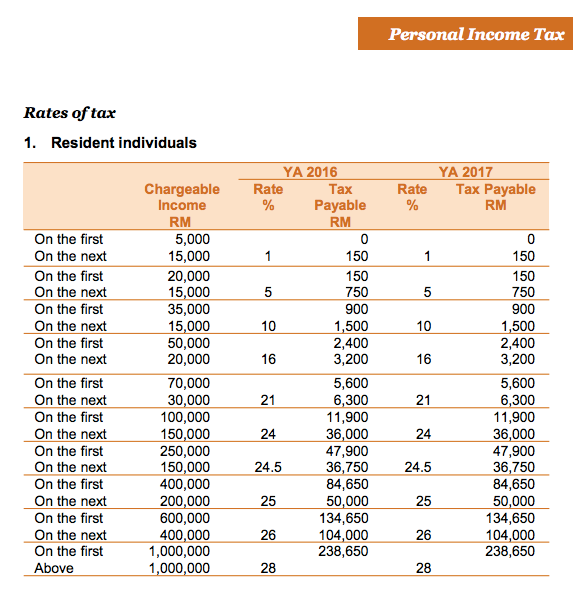

Tax Forms by Year. Malaysia follows a progressive tax rate from 0 to 28.

E Filing Beginners Guide Q A Part 1 Income Tax Malaysia 2022 Youtube

Situations covered assuming no added tax complexity.

. Income tax doesnt just cover your monthly salary but all types of income whether it is from your business or profession employment dividends interest discounts rent. 30042022 15052022 for e-filing 5. Form B Income tax return for individual with business income income other than employment income Deadline.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. However if the company has failed to obtain one the worker can register for an income tax number at the nearest IRB office.

W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. Other income is taxed at a rate of 30. IRS Tax Forms 2009.

However certain types of income specified in Schedule 6 of the ITA such as foreign source income as per paragraph 28 of Schedule 6 are exempt from income tax. If you are an individual earning more than RM34000 per annum which roughly translates to RM283333 per month after EPF deductions you have to register a tax file. I am using purity as my themeWhenever I want to log out I get the message that PurityM isnt installed or needs to be updated.

As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs. Form P Income tax return for partnership Deadline. If a Malaysian or foreign national knowledge worker resides in the Iskandar Development Region and is employed in certain qualifying activities by a designated company and if their employment commences on or after 24 October 2009 but not later than 31 December.

Alice can claim a GST credit of 2 on her activity statement and 20 as an income tax deduction on her tax return. An additional levy of 1 is imposed on high-income earners without private health insurance. The fee is sometimes also required to own a radio or receive radio broadcastsA TV licence is therefore effectively a hypothecated tax for.

Treatment by private doctors is also paid by the government when the doctor direct bills the Health Department Bulk Billing. Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis. To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB.

IRS Tax Forms 2020. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. IRS Tax Forms 2018.

If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability. All taxpayers required to pay tax under reverse charge have to register for GST and the threshold of Rs20 lakh or Rs40 lakh as the case may be does not apply to them. Income tax return for individual who only received employment income Deadline.

This is effected under Palestinian ownership and in accordance with the best European and international standards. But I still get the same message every time I try to log out. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable.

The double tax treaty tells Mark that the UK has the main right to tax the income and that if Germany also wants to tax it then the foreign tax credit method should be used to avoid double tax. Form 1120 US. Medicare is funded partly by a 15 income tax levy with exceptions for low-income earners but mostly out of general revenue.

Free press release distribution service from Pressbox as well as providing professional copywriting services to targeted audiences globally. According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes. I click on update.

Further you can also file. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. End of example If youre not entitled to a GST credit claim the full cost of the business purchase including any GST as a deduction.

A national identification number national identity number or national insurance number or JMBGEMBG is used by the governments of many countries as a means of tracking their citizens permanent residents and temporary residents for the purposes of work taxation government benefits health care and other governmentally-related functions. 30062022 15072022 for e-filing 6. A television licence or broadcast receiving licence is a payment required in many countries for the reception of television broadcasts or the possession of a television set where some broadcasts are funded in full or in part by the licence fee paid.

EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Veteran undertaker Roland Tay Hai Choon was charged on Friday Sep 30 with evading income tax of about S427000 and failing to register his businesses for Goods and Services Tax GST. Income tax filing for sole proprietors is straightforward.

1 Company Name application RM 50-100 2 Company Incorporation SSM Fees RM 1010- 3 Buy Super Form RM 150-200 4 Consultancy Fees RM 1000 to 3000 depend on number of service 5 Virtual Office if no business address is available RM 20 month or FREE first year 6 Secretary fees RM 600 to 1200 year. The ways in which such a. Federal Budgets by Topic.

Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23. Corporation Income Tax Return is used to report the income gains losses deductions credits and to figure the income tax liability of a corporation. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

Approximate fees of company registration. In Malaysia income tax is charged based on income accruing in derived from or received in the country as stated under Section 3 of the Income Tax Act 1967 ITA. Non-residents are subject to withholding taxes on certain types of income.

Office of the Federal Register OFR General Services Administration GSA Federal Trade Commission FTC. The following table is the summary of the offences fines penalties for each offence. As per Income Tax Act ITA 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences.

Cost of Living. Unless exempt under section 501 all domestic corporations must file an income tax return whether or not they have taxable income. Only certain taxpayers are eligible.

Normally companies will obtain the income tax numbers for their foreign workers.

Malaysia Sst Sales And Service Tax A Complete Guide

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Income Tax Number Registration Steps L Co

7 Tips To File Malaysian Income Tax For Beginners

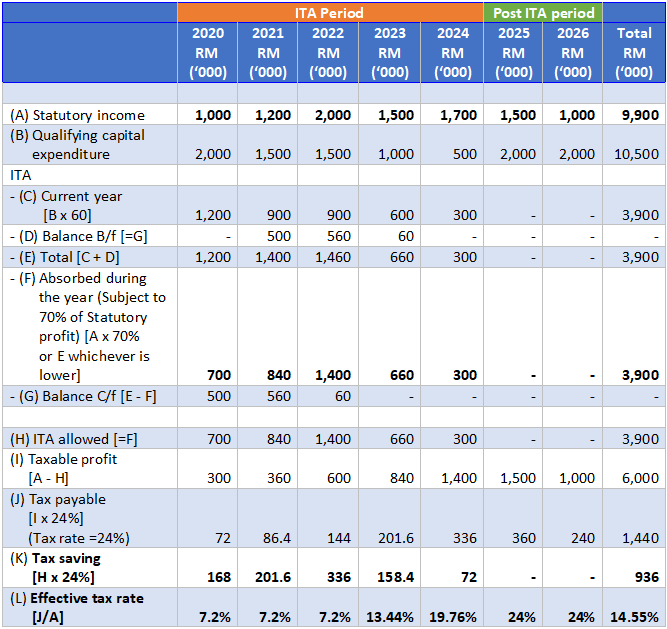

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

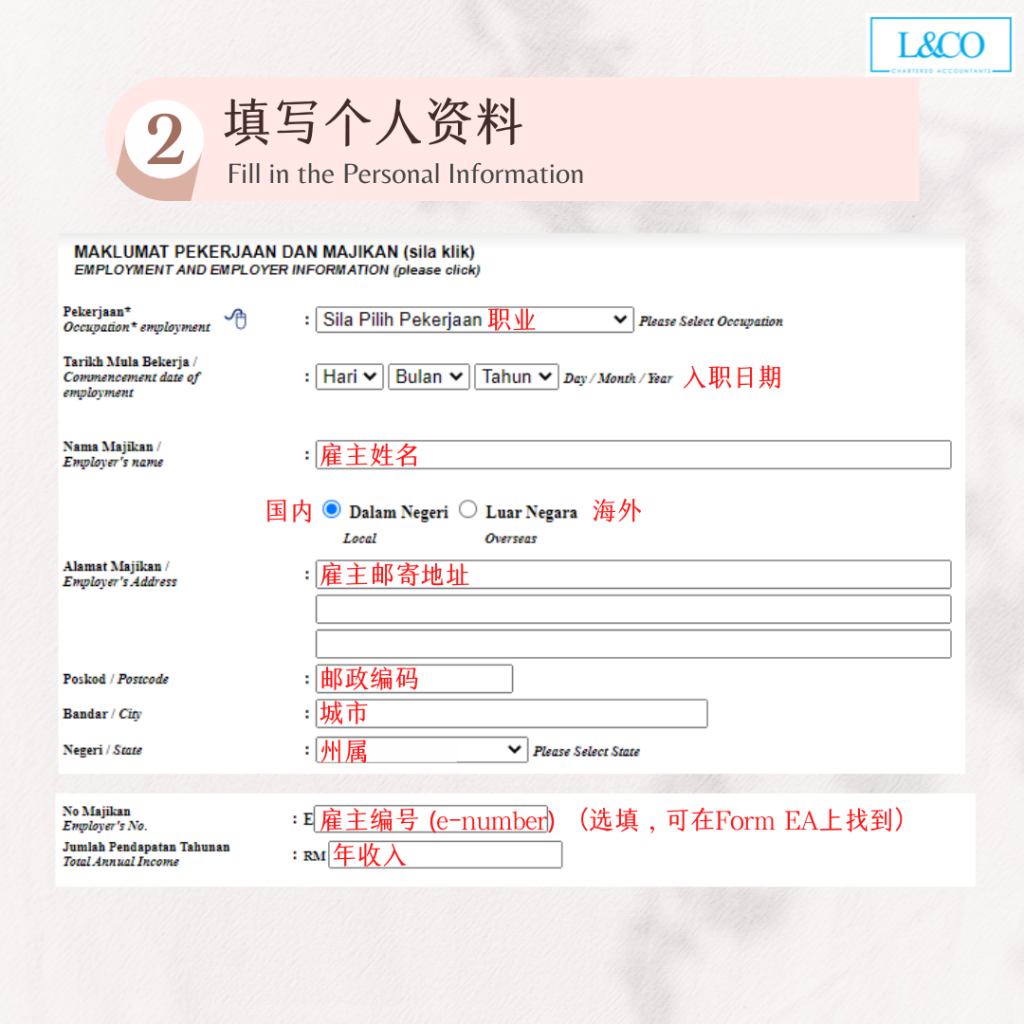

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

10 Things To Know For Filing Income Tax In 2019 Mypf My

How To File Your Taxes For The First Time

Guide On Personal Tax Filing For Expatriate Employed By Labuan Company

E Filing Beginners Guide Income Tax Malaysia 2022 Youtube

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

The Complete Income Tax Guide 2022

Income Tax Non Compliance Of Small And Medium Enterprises In Malaysia Determinants And Tax Compliance Costs Semantic Scholar

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Comments

Post a Comment